LONDON, 7 July 2008 - Nearly half of pension schemes managers have undertaken an investment shift from equities to bonds during the past 12 months according to research released today by Aon Consulting, a leading pension, benefits and HR consulting firm. Aon conducted a survey of over 100 defined benefit pension managers across the UK, asking a series of questions regarding changes made to their investment strategies in the previous 12 months.

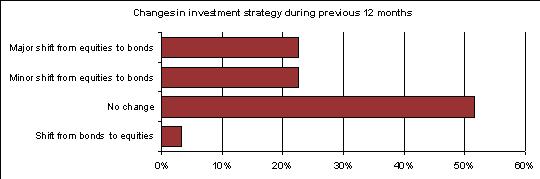

Nearly half (46 per cent) of schemes said they had reallocated investments from equities to bonds. Breaking this down, almost a quarter of schemes (23 per cent) reallocated a major shift [1] from equities to bonds and the same proportion reallocated a minor shift [2] in the same way.

The survey found that just over half 54 per cent had made no change at all to their investment strategy.

Growth of non equity assets

The survey found that pension schemes have adopted a wider range of diversifying asset classes, which are used to reduce investment risk without reducing expected returns. UK property continued to be the most popular non-equity asset, with almost half of all schemes (44 per cent) holding this investment type in their portfolio.

Diversified growth funds have also proved popular with schemes, with a fifth choosing to invest at least part of their portfolio in such vehicles. Over two fifths have invested in private equity or hedge funds (absolute return funds), whilst a fifth have invested in diversified growth funds.

Among other findings, commitment to liability driven investment (LDI) has not grown significantly. The 13 per cent of schemes choosing to match assets and liabilities in this way remained at similar levels to Aon’s 2007 survey. The stagnation is largely due to the relatively low levels of long-term interest rates, keeping the price of LDI strategies too high for many trustees and sponsors.

Commenting on the findings, Daniel Peters, investment consultant and actuary, said: "It's no surprise that as pension schemes mature and trustees become increasingly risk aware, nearly half have moved some part of their growth portfolio into matching assets. To reduce volatility further, growth assets require diversification away from equities.

"Alternative assets such as funds of hedge funds that have low correlations with more traditional investments can be used to target a similar level of return to equities but with lower volatility. Indeed, whilst equity values fell over the first quarter of 2008, many funds of hedge funds have proven remarkably resilient.

"Initial indications show that during the credit crunch and the subsequent fall out already seen during 2008, volatility of these funds is considerably reduced compared to the traditional equity-only strategies."

[1] A major shift is at least 10 per cent of growth assets

[2] A minor shift is less than 10 per cent of growth assets

Ends

For more information contact

Leo Wood / Susie Patterson

0207 269 7137 / 233, leo.wood@fd.com / susie.patterson@fd.com

Notes to editors

About the survey

Aon Consulting conducted the survey in spring 2008. Building on previous Employer Surveys, the research provides an invaluable insight into the impact that pensions issues are having on businesses operations and how employers are addressing these issues.

The survey questions over 100 managers of defined benefit pension scheme provision in the UK. Respondents included finance directors (26 per cent), pension scheme managers (42 per cent) and HR managers (16 per cent), as well as other senior executives such as Chief Executive Officers and company secretaries.

By size, over a quarter of schemes have assets in excess of £500m (26 per cent), another quarter (27 per cent) have assets worth between £100m and £500m, a quarter (27 per cent) in the £25m - £100m range and the remainder (20 per cent) having up to £25m of assets.

About Aon Consulting

Aon Consulting is a leading human capital consultancy, helping organisations of every size to attract and keep the employees they need. We advise on all aspects of employment, including health-related insurance and risk; employee compensation and pensions; human resource strategy planning; job design and change management; and staff assessment and legal issues. Aon Consulting is a division of Aon, one of the UK's largest insurance brokers and providers of risk management services and a major force in reinsurance and the UK human capital consulting market. Aon Consulting Limited is authorised and regulated by the Financial Services Authority.

About Aon

Aon Corporation (NYSE:AOC) is the leading global provider of risk management services, insurance and reinsurance brokerage, human capital and management consulting. Through its 36,000 colleagues worldwide, Aon readily delivers distinctive client value via innovative and effective risk management and workforce productivity solutions. Our industry-leading global resources, technical expertise and industry knowledge are delivered locally through more than 500 offices in more than 120 countries. Aon was named the world's best broker by Euromoney magazine's 2008 Insurance Survey. Aon also was ranked by A.M. Best as the number one global insurance brokerage in 2007 based on brokerage revenues, and voted best insurance intermediary, best reinsurance intermediary, and best employee benefits consulting firm in 2007 by the readers of Business Insurance. For more information on Aon, log onto www.aon.com.

Aon Limited is authorised and regulated by the Financial Services Authority in respect of insurance mediation activities only.

Access international media contacts, the full library of Aon media releases, and a media kit with fact sheet and executive bios, via links below.