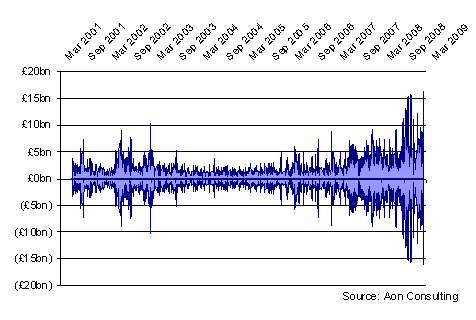

LONDON, 05 March 2009 The last five days have been the most volatile on record for UK final salary pension schemes, according to Aon Consulting, the leading employee risk and benefits management firm. In a week when world financial markets suffered huge volatility, the FTSE dipped to its lowest level in six years, and AA corporate bond yields have been erratic, Aon has calculated the knock-on effect for final salary pension schemes, as measured by company accounts.

Combined deficits for the UK’s 200 largest defined benefit schemes over the last five days, as calculated by the Aon200:

· Thurs 26 February £38bn

· Fri 27 February £41bn

· Mon 2 March £68bn

· Tues 3 March £73bn

· Weds 4 March £56bn

Commenting on the falls, Marcus Hurd, head of corporate solutions at Aon Consulting, said: “The past week has been the most volatile for final salary pension schemes since accounting standards were changed in June 2001. Monday posted the biggest single day loss on record, a huge £27bn, which dwarfed the previous biggest loss of £16bn on 15 October 2008.

“During the past five days, the deficit peaked at a massive £73bn, the highest level since February 2006. This was prompted by the large losses in the equity markets and the 0.25% drop in corporate bond yields.

“We are seeing swings of unprecedented proportions at the current time. With one half of companies about to formally report their position at 31 March, this is a real concern. Depending on where markets settle at midnight on Tuesday 31 March, this will determine how companies report their balance sheets and 2009 profitability.

“Company Directors are facing a roulette wheel of pension scheme deficits and hoping that markets are at a high when the ball stops rolling. The levels of changes we are seeing are frightening even the hardiest Finance Director. A cool head and knowledge of all the options available are essential in these difficult times.”

Ends

For more information contact

Susie Patterson / Leo Wood

0207 269 7233 / 137

susie.patterson@fd.com / leo.wood@fd.com

David Skapinker

020 7505 7478

david.skapinker@aon.co.uk

http://aon.mediaroom.com

About Aon Consulting

Aon Consulting Worldwide is among the top global human capital consulting firms, with 2008 revenues of $1.358 billion and more than 6,300 professionals in 117 offices worldwide. Aon Consulting works with organizations to improve business performance and shape the workplace of the future through employee benefits, talent management and rewards strategies and solutions. Aon Consulting was named the best employee benefit consulting firm by the readers of Business Insurance magazine in 2006, 2007 and 2008. For more information on Aon, please visit www.aon.mediaroom.com.

Safe Harbour Statement: http://aon.mediaroom.com/index.php?s=67

Aon Limited is authorised and regulated by the Financial Services Authority in respect of insurance mediation activities only.

Access international media contacts, the full library of Aon media releases, and a media kit with fact sheet and executive bios, via links below.