LONDON, 3 December 2007 – Pension scheme deficits, as reported in UK company accounts, are set to fall significantly this year, according to Aon Consulting, a leading pension, benefits and HR consulting firm. 2007 is on course to be the second year in succession that companies will record pensions deficit gains in excess of £30 billion.

The aggregate deficit of the 200 largest UK defined benefit (DB) pension schemes has improved dramatically by £38 billion during the year, from £41bn in December 2006 to £3bn in November 2007. The average funding level of such schemes is now at 99 per cent (up from 92 per cent in 2006).

These gains are welcome news for around one half of all UK companies who prepare their company accounts at 31 December. With just one month to go before the critical date, these companies are set to record significant pension scheme improvements in their accounts.

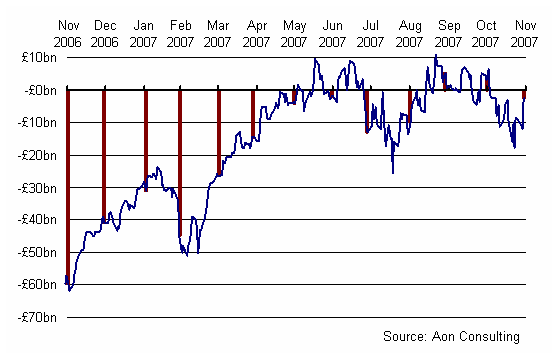

The analysis is the latest in Aon’s Consulting’s monthly tracker of aggregate net surplus (or deficit) for the UK’s 200 largest DB schemes, including all those in the FTSE 100.

As illustrated in the graph below, the aggregate deficit at the end of November is £3 billion – this represents 49 per cent of schemes being in surplus. The £3 billion deficit is a considerable improvement on the deficits of £41 billion in December 2006 and £72 billion in December 2005.

The large improvements are due mainly to improvements in corporate bond yields, the contentious benchmark measure of pension scheme accounting liabilities. Corporate bond yields have improved despite stable government bond yields, which some consider to be a more appropriate measure. The increased difference between the two measures reflects that the market is pricing a higher risk of default of UK companies following this summer’s tightening of credit conditions.

Commenting on the latest figures, Marcus Hurd, senior consultant and actuary at Aon Consulting, said: “UK companies will welcome the news of improved pension scheme balance sheets in their company accounts. Considerable gains are likely for the second consecutive year, which will ease the short-term balance sheet pressures for company finance directors. Volatility persists, however, and companies are advised to review pension scheme risk while the accounting balance sheet remains strong.

“Ironically, the second year of gains has been driven by the market pricing higher credit risk on corporate bonds. Critics of pensions accounting standards will argue that these gains are superficial, but the reality of company reporting is that these gains will be reflected in company accounts.”

Comparative figures for the FTSE 100 companies since November 2006 are as follows:

|

Date

|

Total surplus (deficit) under FRS17/IAS19

|

|

30 November 2006

|

(£37bn)

|

|

31 December 2006

|

(£33bn)

|

|

31 January 2007

|

(£23bn)

|

|

28 February 2007

|

(£35bn)

|

|

31 March 2007

|

(£19bn)

|

|

30 April 2007

|

(£9bn)

|

|

31 May 2007

|

(£2bn)

|

|

30 June 2007

|

(£1bn)

|

|

31 July 2007

|

(£8bn)

|

|

31 August 2007

|

(£5bn)

|

|

30 September 2007

|

£5bn

|

|

31 October 2007

|

£4bn

|

|

30 November 2007

|

£0bn

|

Source: Aon Consulting

About Aon Consulting

Aon Consulting is a leading global human capital consultancy, helping organisations of every size to attract and keep the employees they need. We advise on all aspects of employment, including health-related insurance and risk; employee benefits and pensions; human resource strategy planning; job design and change management; and staff assessment and legal issues. Aon Consulting is a division of Aon, one of the UK’s largest insurance brokers and providers of risk management services and a major force in reinsurance and the UK human capital consulting market. Aon Consulting Limited is authorised and regulated by the Financial Services Authority.

About Aon

Aon Corporation (www.aon.com) is a leading provider of risk management services, insurance and reinsurance brokerage, human capital and management consulting, and specialty insurance underwriting. There are 43,000 employees working in Aon’s 500 offices in more than 120 countries. Backed by broad resources, industry knowledge and technical expertise, Aon professionals help a wide range of clients develop effective risk management and workforce productivity solutions.

This press release contains certain statements related to future results, or states our intentions, beliefs and expectations or predictions for the future which are forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from either historical or anticipated results depending on a variety of factors. Potential factors that could impact results include: general economic conditions in different countries in which we do business around the world, changes in global equity and fixed income markets that could affect the return on invested assets, fluctuations in exchange and interest rates that could influence revenue and expense, rating agency actions that could affect our ability to borrow funds, funding of our various pension plans, changes in the competitive environment, our ability to implement restructuring initiatives and other initiatives intended to yield cost savings, our ability to execute the stock repurchase program, potential regulatory or legislative changes that would affect our ability to sell, and be reimbursed at current levels for, our Sterling subsidiary’s Medicare health product, changes in commercial property and casualty markets and commercial premium rates that could impact revenues, changes in revenues and earnings due to the elimination of contingent commissions, other uncertainties surrounding a new compensation model, the impact of investigations brought by state attorneys general, state insurance regulators, federal prosecutors, and federal regulators, the impact of class actions and individual lawsuits including client class actions, securities class actions, derivative actions, ERISA class actions, the impact of the analysis of practices relating to stock options, the cost of resolution of other contingent liabilities and loss contingencies, and the difference in ultimate paid claims in our underwriting companies from actuarial estimates. Further information concerning the Company and its business, including factors that potentially could materially affect the Company’s financial results, is contained in the Company’s filings with the Securities and Exchange Commission.

Total FRS17/IAS19 surplus (or deficit) for the UK’s largest 200 companies