LONDON, 27 June 2008 – The UK workforce has branded their obese and smoking colleagues the worst offenders when it comes to taking excessive time off work, according to new research. Aon Consulting, the UK’s leading pension, benefits and HR consulting firm said that the findings underpin the importance for employers to encourage a healthier lifestyle in their workforce if they are to minimise the impact on their bottom line through lost productivity.

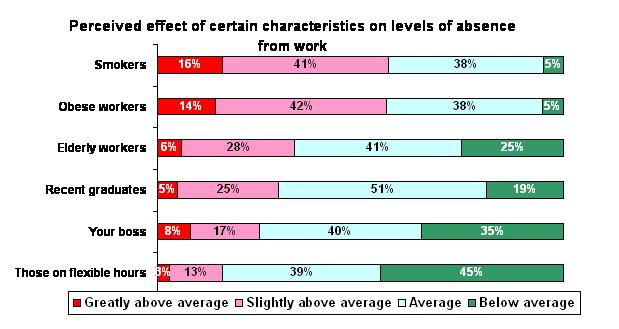

Aon Consulting polled 1,300 working adults nationally, asking them about the effect of six different characteristics on levels of absence from work. Of the six categories (smokers; the obese; the elderly; recent graduates; your boss; or those on flexible hours), the findings showed that the majority of people (57 per cent and 56 per cent respectively) believed smokers and the obese take more than acceptable levels of absence from work. This was substantially more than elderly workers (34 per cent believed they took above average levels of absence), recent graduates (30 per cent), their boss (25 per cent) or those on flexible hours (16 per cent).

Additional findings include:

- The elderly, despite a lifetime of hard work, were not given much leeway, with more than a third (34%) of workers saying mature workers are notorious for their unauthorised time off work.

- Older workers (aged 55 years and above) were also more likely to be critical of the impact of smoking and obesity – 66 per cent and 71 per cent respectively say that absence levels are above average in these categories.

- Interestingly, ‘the Boss,’ was deemed not to be a big a culprit as others, indeed over a third of employees (35%) say that their superior takes below average levels of absence.

- In a positive sign for proponents of flexible working conditions, only 16%, the lowest of all categories, of those on flexible hours are viewed as taking an above average amount of days off work.

Commenting on the survey’s findings, Alex Bennett, head of health consulting at Aon consulting, said: “Whilst of course there are health reasons that employers should help their workforce either quit smoking or lose weight, from a financial point of view it is in the best interest of businesses to implement programmes aimed at assisting this. Extra days off work means lost productivity which hurts the bottom line. Indeed, such programmes often can pay for themselves within a relatively short amount of time.

“The opinions uncovered in the survey are also borne out by the available facts. Recent studies in the Netherlands showed that seriously obese employees and those that smoke are demonstrably absent from work more often than employees of normal weight and non smokers. Indeed not only do they report in absent more frequently, but they remain absent for longer too.

Many employers have already moved to support smoking cessation in the workplace offering counseling support within work schedules to complement the services offered under the NHS as recommend by NICE and including nicotine replacement therapy. There is no reason why support for employees wishing to address obesity and related modifiable health factors, cannot be incorporated in occupational health and employee health benefit strategies. Appropriate investment in these areas can be proven to derive clear business returns if managed and measured correctly.”

Ends

For more information contact

0207 269 7137 / 250

leo.wood@fd.com / Josephine.corbett@fd.com

Notes to editors

About the research

The questions were placed online and invitations were issued to a sample of working adults from a national panel of 600,000. Controls were included to ensure a broadly representative spread of completions, by gender, age and region. 1,296 working adults successfully completed the survey between 4th and 9th April 2008.

About Aon Consulting

Aon Consulting is a leading human capital consultancy, helping organisations of every size to attract and keep the employees they need. We advise on all aspects of employment, including health-related insurance and risk; employee compensation and pensions; human resource strategy planning; job design and change management; and staff assessment and legal issues. Aon Consulting is a division of Aon, one of the UK’s largest insurance brokers and providers of risk management services and a major force in reinsurance and the UK human capital consulting market. Aon Consulting Limited is authorised and regulated by the Financial Services Authority.

About Aon

Aon Corporation (NYSE:AOC) is the leading global provider of risk management services, insurance and reinsurance brokerage, human capital and management consulting. Through its 36,000 colleagues worldwide, Aon readily delivers distinctive client value via innovative and effective risk management and workforce productivity solutions. Our industry-leading global resources, technical expertise and industry knowledge are delivered locally through more than 500 offices in more than 120 countries. Aon was named the world’s “best broker” by Euromoney magazine’s 2008 Insurance Survey. Aon also was ranked by A.M. Best as the number one global insurance brokerage in 2007 based on brokerage revenues, and voted best insurance intermediary, best reinsurance intermediary, and best employee benefits consulting firm in 2007 by the readers of Business Insurance. For more information on Aon, log onto www.aon.com

This press release contains certain statements related to future results, or states our intentions, beliefs and expectations or predictions for the future which are forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from either historical or anticipated results depending on a variety of factors. Potential factors that could impact results include: general economic conditions in different countries in which we do business around the world, changes in global equity and fixed income markets that could affect the return on invested assets, fluctuations in exchange and interest rates that could influence revenue and expense, rating agency actions that could affect our ability to borrow funds, funding of our various pension plans, changes in the competitive environment, our ability to implement restructuring initiatives and other initiatives intended to yield cost savings, changes in commercial property and casualty markets and commercial premium rates that could impact revenues, the outcome of inquiries from regulators and investigations related to compliance with the U.S. Foreign Corrupt Practices Act and non-U.S. anti-corruption laws, the impact of investigations brought by U.S. state attorneys general, U.S. state insurance regulators, U.S. federal prosecutors, U.S. federal regulators, and regulatory authorities in the U.K. and other countries, the impact of class actions and individual lawsuits including client class actions, securities class actions, derivative actions, ERISA class actions, and the cost of resolution of other contingent liabilities and loss contingencies. Further information concerning the Company and its business, including factors that potentially could materially affect the Company's financial results, is contained in the Company's filings with the Securities and Exchange Commission.

Aon Limited is authorised and regulated by the Financial Services Authority in respect of insurance mediation activities only.

Access international media contacts, the full library of Aon media releases, and a media kit with fact sheet and executive bios, via links below.