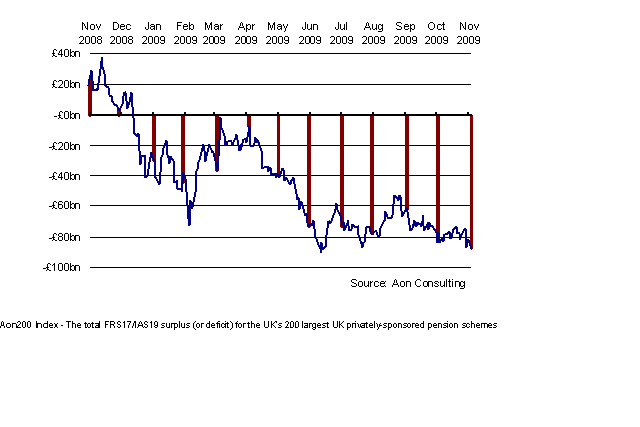

LONDON, 03 December 2009 It is unlikely that pension scheme deficits will recover without proactive management, according to Aon Consulting, the leading employee risk and benefits management firm. The aggregate pension fund deficit in company accounts for the 200 largest UK privately sponsored pension schemes ballooned again in November from £78 billion to £88 billion.

The £88bn deficit would take drastic action to repair. If it were to be reduced to zero over the next seven years, this would require investment returns of 11% per annum, equivalent to the FTSE100 reaching 9000; or company contributions of £15bn per annum (purely to clear the deficit, excluding all costs for new benefits).

In practice, the deficit could be recovered by a combination of these approaches but Aon believes that many schemes will be considering reducing members’ benefits to help manage their deficits.

It is likely that increased contribution requirements stemming from the market falls over the past two years will drive employers into reconsidering the future of their schemes. Common options are scheme closure, whereby no future pension is provided from the scheme and benefits are frozen (so that the link between salary and pension is lost) or providing a lower pension.

The prospects for the provision of defined benefit pensions seem bleaker still when the wider move to make pension funding more rigorous is considered. The Pensions Regulator’s recent requirement for greater scheme funding has pushed up contribution requirements for companies.

On top of this, Solvency II (not yet applicable to pension funds) is likely to raise the cost of purchasing annuities, while the UK Accounting Standards Board is proposing that risk-free discount rates be used when determining the pensions deficit on the company balance sheet. Both these dynamics are likely to discourage DB pension provision even further.

Commenting on the latest figures, Marcus Hurd, head of corporate solutions at Aon Consulting, said: “As things stand, the inescapable reality is that pension deficits are here to stay until the final salary scheme is passed across to an insurance company and employers will have to think carefully about how to handle the situation.

“There is no quick fix imminent in financial markets and the size of the challenge for UK companies is immense. In order for pension schemes to return to balance in aggregate within the next seven years, we need either the FTSE to return 11% per annum or for companies to inject £15bn per annum.

“In addition, the measures to value final salary pension scheme liabilities are under severe pressure to become even stronger, making pension deficits look even greater. There is no easy way of clearing a pension scheme deficit and as employers wake up to the reality of their pension promises, we would expect to see more and more companies shying away from defined benefit schemes and looking to the lower risk defined contribution options instead.”

- ENDS -

For more information contact

Leo Wood / Josephine Corbett

0207 269 7137 / 250

Leo.wood@fd.com / josephine.corbett@fd.com

David Skapinker

020 7505 7478

david.skapinker@aon.co.uk

About Aon Consulting

Aon Consulting Worldwide is among the top global human capital consulting firms, with 2008 revenues of $1.358 billion and more than 6,300 professionals in 117 offices worldwide. Aon Consulting works with organisations to improve business performance and shape the workplace of the future through employee benefits, talent management and rewards strategies and solutions. Aon Consulting was named the best employee benefit consulting firm by the readers of Business Insurance magazine in 2006, 2007 and 2008. For more information on Aon, please visit www.aon.mediaroom.com.

Safe Harbour Statement: http://aon.mediaroom.com/index.php?s=67

Aon Consulting Limited is authorised and regulated by the Financial Services Authority

Access international media contacts, the full library of Aon media releases, and a media kit with fact sheet and executive bios, via links below.