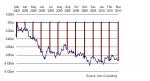

LONDON, 01 April 2010 Over a half of companies are about to report huge increases in their final salary pension scheme deficits in their 31 March company accounts, with the aggregate deficit increasing by £57 billion during the financial year, according to Aon Consulting, the leading employee benefits and risk management firm The aggregate pension fund deficit shown in company accounts for the 200 largest UK privately sponsored pension schemes increased from £36 billion in March 2009 to £93 billion at the end of March 2010.

Most UK companies use the financial year as their company year and final salary pensions will once again be dominating the boardroom discussions. Many companies will have been tracking this position over the last few months knowing that it will be the big issue for UK companies as they prepare their accounts at 31 March.

For many businesses, the increased deficits appear incomprehensible during a period that the assets of these pension schemes have increased by £118 billion. The accounting liabilities of those schemes, however, have ballooned by a staggering £175 billion to £591 billion. The increases in the scheme liabilities have been caused by falling AA corporate bond yields (6.9% to 5.6%) and rising expectations of future long-term inflation (3.0% to 3.9%).

The disparity between scheme assets and scheme liabilities demonstrates the importance of genuinely integrated asset liability solutions. Although many companies are moving towards these models, there are still many that are behind the curve in their thinking. The harshest pain is felt by those that have pursued asset liability solutions, but are now being hurt by the discrepancy between the scheme’s liabilities and the way they are required to account for them.

Commenting on the latest figures, Marcus Hurd, head of corporate solutions at Aon Consulting, said: “Pension deficits are once again dominating the board room. This year’s 31 March company accounts will make sorry reading for companies with final salary pension schemes. These numbers will only increase the number of companies looking at restructuring their pension arrangements, including those that have put off the decision during the economic downturn.

“It’s a harsh reality that you cannot look at pension scheme assets and liabilities in isolation. The financial sophistication is there for companies to hedge a significant proportion of pension scheme risk, so it remains surprising that many are still so significantly exposed. On this occasion, however, even those that did hedge their pension risk are feeling the pain, as the pension scheme accounting measure moves back to something nearer reality.”

Ends

For more information contact

Leo Wood

0207 269 7137 / 07809 496526

David Skapinker

020 7505 7478

david.skapinker@aon.co.uk

About Aon Consulting

Aon Consulting is among the top global human capital consulting firms, with more than 6,300 professionals in 229 offices worldwide. The firm works with organizations to improve business performance and shape the workplace of the future through employee benefits, talent management and rewards strategies and solutions. Aon Consulting was named the best employee benefit consulting firm by the readers of Business Insurance magazine in 2006, 2007, 2008 and 2009. For more information on Aon Consulting, please visit http://www.aon.com/human-capital-consulting

Aon Consulting Limited is authorised and regulated by the Financial Services Authority

Access international media contacts, the full library of Aon media releases, and a media kit with fact sheet and executive bios, via links below.